HighPoint

Rare For Rent Condo Sale Opportunity in San Diego

Want to learn

more?

Download the pitch deck for the

investment.

Want to learn more?

Download the pitch deck for the investment.

WHY?

HighPoint

The property was originally built in 1982 as a 50 unit

condo complex complete with individual water and

utility hookups, washer/dryer installations, and a

condo map with 50 individual APNs. This presents an incredibly rare opportunity to acquire at apartment

pricing and exit at significantly higher condo prices.

The market is in dire need of middle income housing.

By using FHA and VA take out financing for buyers,

this gives an incredible opportunity for families to own

in San Diego between $350,000 and $550,000.

Additionally it allows our team to mitigate risk. We

will renovate the 50 units and sell them individually

over an 18-24 month timeline.

WHY?

HighPoint

The property was originally built in 1982 as a 50 unit condo complex complete with individual water and utility hookups, washer/dryer installations, and a condo map with 50 individual APNs. This presents an incredibly rare opportunity to acquire at apartment pricing and exit at significantly higher condo prices. The market is in dire need of middle income housing. By using FHA and VA take out financing for buyers, this gives an incredible opportunity for families to own in San Diego between $350,000 and $550,000. Additionally it allows our team to mitigate risk. We will renovate the 50 units and sell them individually over an 18-24 month timeline.

Want to learn more?

Schedule a call with our team at your convenience.

PROPERTY

HIGHLIGHTS

Description

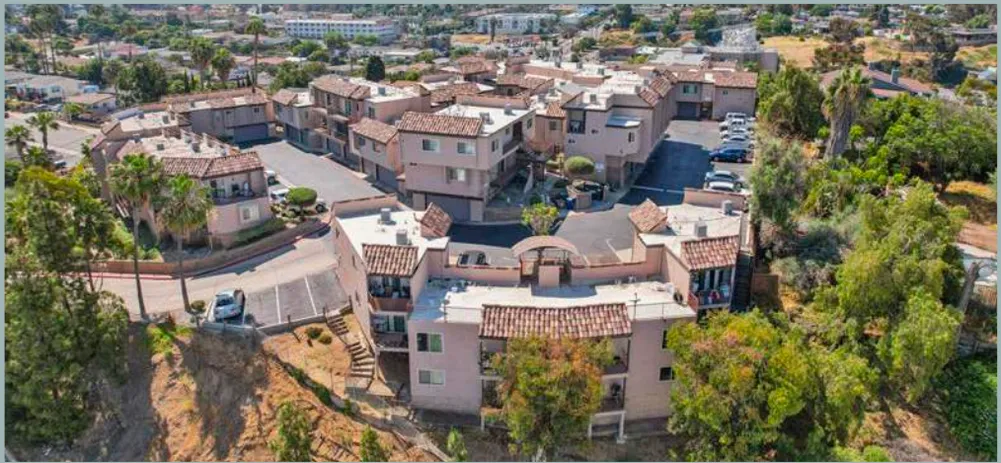

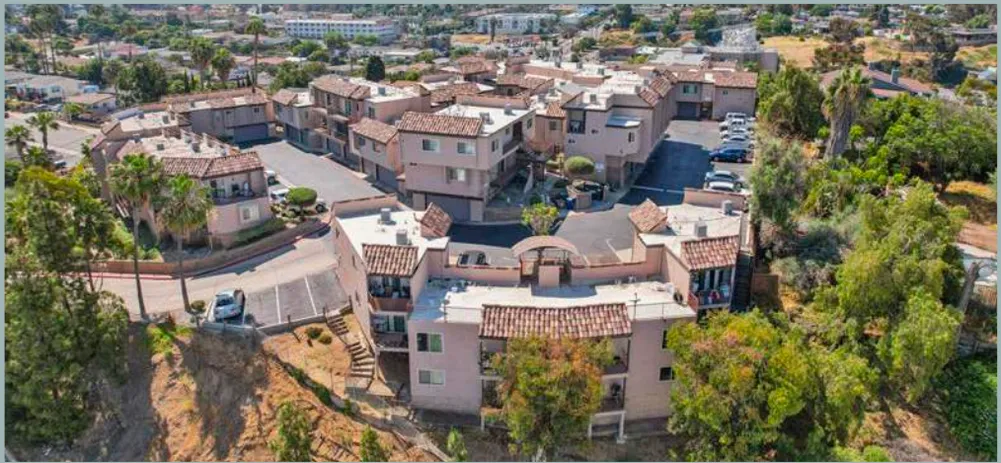

Spread over nearly 2 acres, HighPoint comprises 50 Units, a gated entrance, central location to major employers, Navy freeways and more.

Unit Mix

The property offers a total of

50 units, containing 70% 2bedroom units, 28%

1bedroom and 2% three-bedroom units. There is a mix of town home units and flats.

Condo Map

Originally built as a 50 unit condo complex in 1982, complete with individual water and utility hookups, washer/dryer installations, and a condo map with 50 individual APNs.

Features

The complex features and highpoint bluff living, secure gated access, garages, storage and quick access to freeways and employers.

PROPERTY

HIGHLIGHTS

Description

Spread over nearly 2 acres, HighPoint comprises 50 Units, a gated entrance, central location to major employers, Navy freeways and more.

Unit Mix

The property offers a total of

50 units, containing 70% 2bedroom units, 28%

1bedroom and 2% three-bedroom units. There is a mix of town home units and flats.

Condo Map

Originally built as a 50 unit condo complex in 1982, complete with individual water and utility hookups, washer/dryer installations, and a condo map with 50 individual APNs.

Features

The complex features and highpoint bluff living, secure gated access, garages, storage and quick access to freeways and employers.

INVESTMENT

OPPORTUNITY

Holding Period:

The anticipated holding period is 18 to 24 months, allowing for 50 unit renovations and sales.

Capital Raise:

The General Partners seek to secure $4.5-5 million in equity to complete the project, enabling the development to move forward successfully.

Construction Loan:

The General Partners plan to secure $17-$18M in acquisition and renovation loan construction. Loan terms TBD, but are expected at SOFR + 570 or approx. 10-11%

Take-Out Loan Summary:

Upon renovation of the units, we will sell them to end users. By utilizing our in-house sales team and preferred lending partner, we anticipate VA and FHA financing as well as attractive 5% down condo financing.

Minimum Investment:

The minimum investment required is $50,000 per LP interest, with the General Partner reserving the right to accept smaller subscriptions at their discretion.

INVESTMENT

OPPORTUNITY

Holding Period:

The anticipated holding period is 18 to 24 months, allowing for 50 unit renovations and sales.

Capital Raise:

The General Partners seek to secure $4.5-5 million in equity to complete the project, enabling the development to move forward successfully.

Construction Loan:

The General Partners plan to secure $17-$18M in acquisition and renovation loan construction. Loan terms TBD, but are expected at SOFR + 570 or approx. 10-11%

Take-Out Loan Summary:

Upon renovation of the units, we will sell them to end users. By utilizing our in-house sales team and preferred lending partner, we anticipate VA and FHA financing as well as attractive 5% down condo financing.

Minimum Investment:

The minimum investment required is $50,000 per LP interest, with the General Partner reserving the right to accept smaller subscriptions at their discretion.

BUSINESS PLAN

OVERVIEW

Renovate and sell: This presents an incredibly rare opportunity to acquire at apartment pricing and exit at significantly higher condo prices. We will renovate 50 for rent condo units and sell them individually over an 18-24 month timeline.

Using our in-house construction and sales teams we will strategically plan renovations while maintaining revenue from the rentals.

Financial Strategy: Financed with a $17-18M loan and $4.5-5M capital raise.

Investor Returns: 8% -10%preferred return for investors, with additional 60% of profits upon property sale.

Exit Strategy: Targeted sales to begin within 4-6 months of renovation starts.

Want to learn more?

Schedule a call with our team at your

convenience.

RETURN

STRUCTURE

LP preferred return options:

$50,000 - $99,000 investment - 8% preferred return$100,000 or more - 10% preferred return

LP Profit splits: Limited partners will receive 60% of the profits and cash distributions.

Projected returns: ROI 60% with annual rate of return projected at 30%.

24 month investment timeline.

RETURN

STRUCTURE

LP preferred return options:

$50,000 - $99,000 investment - 8% preferred return$100,000 or more - 10% preferred return

LP Profit splits: Limited partners will receive 60% of the profits and cash distributions.

Projected returns: ROI 60% with annual rate of return projected at 30%.

24 month investment timeline.

READY TO

GET STARTED?

Schedule a 1-on-1 call with a member of

our investor relations team to learn more.

Fish Legacy Holdings LLC is a vertically integrated multifamily investment firm led by a team of seasoned industry experts. We combine institutional rigor with entrepreneurial agility, consistently implementing cutting-edge strategies for every asset we acquire. Our mission is to elevate the living experience for residents in each community within our portfolio, while prioritizing capital preservation for our investors. This disciplined approach has led to exceptional, full-cycle investor returns, making Fish Legacy Holdings LLC a trusted partner for sophisticated investors seeking both stability and growth.

© 2025 Fish Legacy Holdings LLC - Mailing: 3080 Tamiami Trl E Unit 301, Naples Florida 34112

This material does not constitute an offer or a solicitation to purchase securities. An offer can only be made by the Private Placement Memorandum (PPM). This document or page is an informational summary of prospective investment opportunities only. The PPM and its exhibits contain complete information about the Property and the investment opportunity.